2015 financials

(See past years here: 2014, 2013, 2012)

It’s tax time, so I thought it would be a good time for our annual look at the numbers.

Let’s start out with an updated (and simplified) profit and loss statement. For readability, I’ve dropped the thousands off each number. So where it says “$49”, it means “$49,000”.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|---|---|

| Sales | $49 | $298 | $465 | $613 | $836 | $906 | $963 | $1,086 |

| Inventory | $49 | $249 | $368 | $480 | $652 | $686 | $741 | $811 |

| Expenses | $51 | $75 | $140 | $166 | $201 | $189 | $205 | $251 |

| Profit | -$51 | -$26 | -$43 | -$33 | -$17 | $31 | $17 | $24 |

In case that just looks like a jumble of numbers, let me highlight a few things that pop out at me:

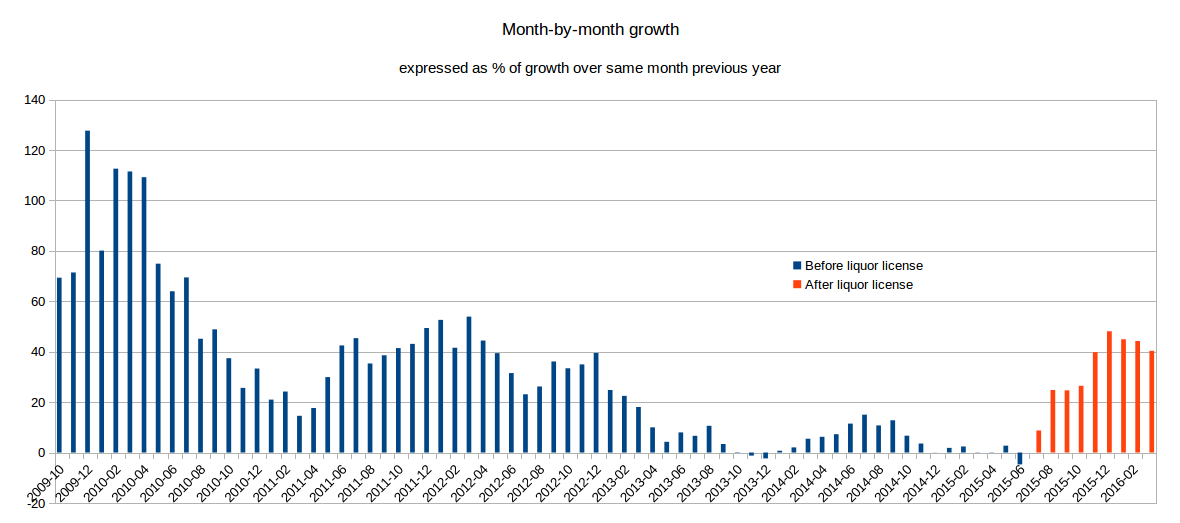

Sales started growing again. From 2013→2014, we grew a measly 6%. From 2014→2015 we grew 13%—but almost all of that took place in the second half of the year. The fourth quarter (Oct,Nov,Dec) of 2015 was 31% higher than the same quarter in 2014.

There were a few reasons why, but the main one was:

We started carrying beer and wine. After a long process (which you can read about here), we got a liquor license in July and have added beer and wine to our mix of groceries and produce. The cool thing about this, from a sales perspective, is it is a new category of item. If we started carrying a new type of pasta, for instance, we wouldn’t necessarily see sales go up—some people would pick up the new pasta, some people would pick up the old pasta, but it wouldn’t necessarily increase the amount of food people buy here. But a bottle of wine is likely to be purchased in addition to the food people are already buying. It doesn’t cannibalize existing sales. And, it helps recapture grocery sales from people who need food and wine and had to make their single shopping trip elsewhere. In fact, for every dollar of beer and wine sales, we’ve seen a matching dollar of grocery sales growth. People are buying more non-alcoholic groceries here because they can pick up beer and wine in the same trip.

Getting a liquor license was a difficult and expensive project, but it seems to have paid off financially.

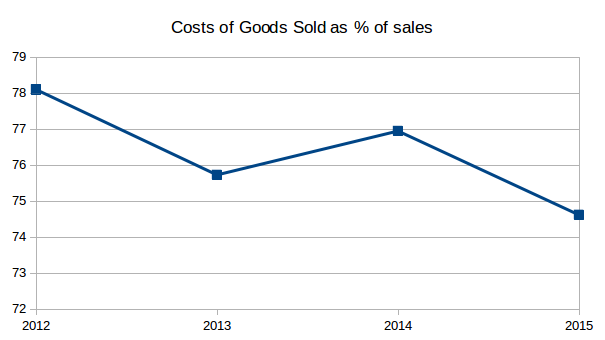

Margins improved. Sales are one metric, and one that is often the first people ask about. But another huge thing we keep our eye on is margins. Let’s look at inventory costs as a percentage of sales:

Our goal here is 70%. And we’ve fought it down from 78% to 74%, so we’re about half way there. This might seem light a small adjustment, but since our gross sales are over $1 million, each percentage point change in this number is an extra $10,000 in profit. If we could get it down from 74% to 72%, for instance, we would double our profit. Tiny adjustments yield big results.

How do we improve this number? Everything from negotiating better deals from vendors, raising prices slightly, reducing produce spoilage, reducing theft, and reducing some other non-inventory things that end up in this category on the simplified profit and loss, like inbound freight costs and credit card processing fees. This is what we as a team are focusing on in 2016.

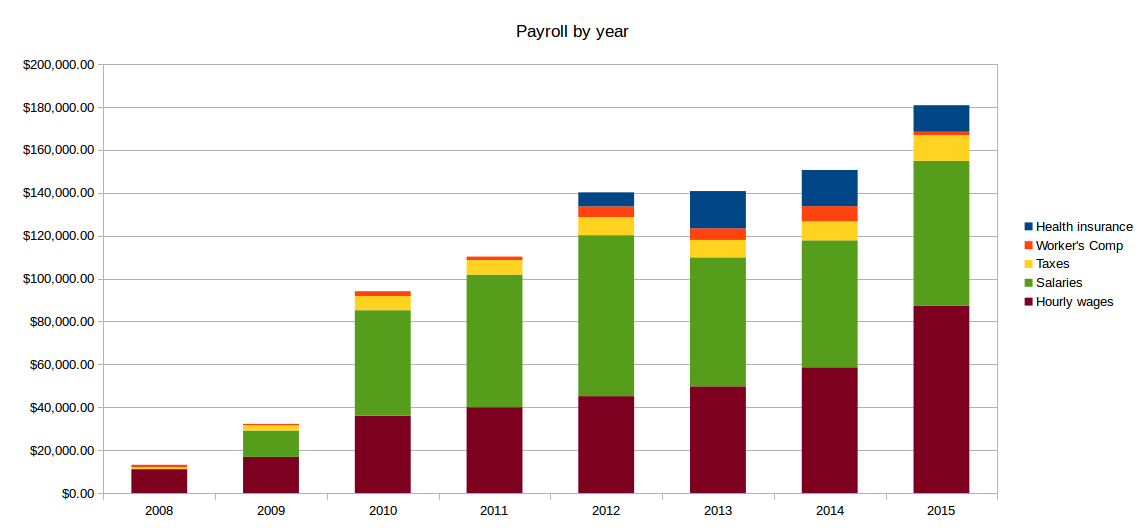

Minimum jumped dramatically. Under the new Chicago Minimum Wage Ordinance, the minimum wage here in Chicago jumped from the Illinois minimum of $8.25 to $10.00 on July 1st, 2015. That’s a huge jump. Which is great for workers, but was a little rough on our P&L. We have about 9,600 clerk hours per year, so if everyone got a $1.75 raise that would be an extra $17,000 (plus various taxes, it comes out to more like $20,000). And it doesn’t just affect people who were making in the $8.25–$10.00 range—I’d say it put upwards wage pressure on any wage under $15.00.

I’m all for a higher minimum wage (Chicago’s is on its way to $13.00 by 2019), but I do wish this first jump would have been softer. A jump from $8.25 to $9.00, followed by $9.75 a year later, would have been an easier transition to deal with from the business owner’s perspective. But I guess this is why businesses don’t get to vote!

Just by coincidence, we received our liquor license within a few days of the wage hike. And I can say for us, that probably saved us from significant financial hardship.

Expenses, especially payroll, went up. Our expenses went up by $46,000. A little of that is small annual bumps in rent and utilities. And between $5,000 and $10,000 is related to getting the liquor license. But the vast majority it went into payroll (always payroll…)—more people, more hours per person, more dollars per hour. Every hour of clerk labor we add per day costs about $4,000 per year. Those add up quick. It’s a huge balancing act to make sure we have enough people scheduled to do the job, but not a single more hour than we need.

Conclusion. Overall, we had a moderate year financially. Gains in sales (in large part due to the liquor license) and margins were offset by a significant government-imposed pay raise (which is not a bad thing). And we’re well positioned to do even better next year, if we capitalize on the beer + wine sales bump and continue to tweak margins by another few percent. More on our goals in our next post.